I. Introduction

A. Getting Why Day Trading Patterns Matter:

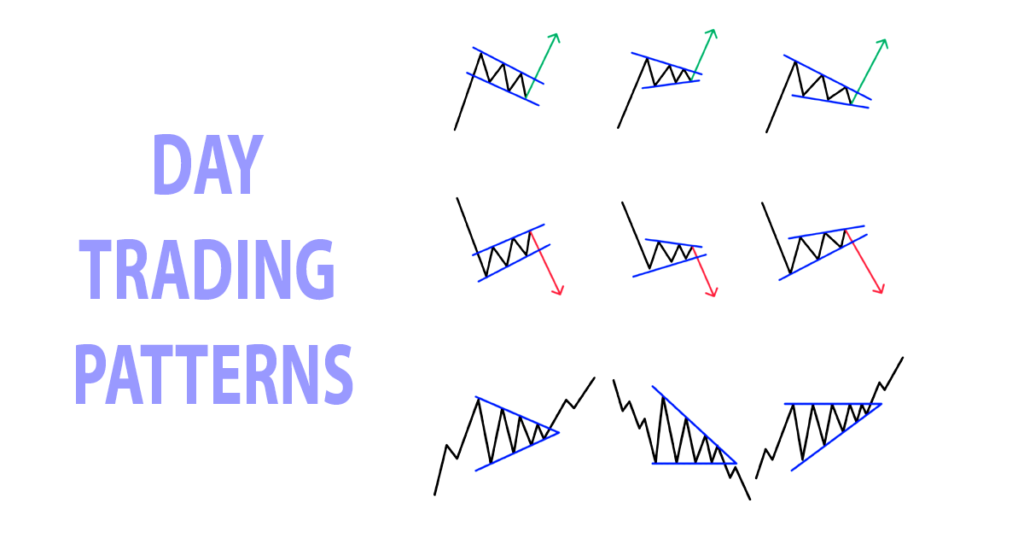

So, folks, let’s kick things off by diving into why these day trading patterns are the bee’s knees when it comes to making those trading moves count. We’re talking about how these price patterns spill the beans on market vibes, the good ol’ supply and demand dance, and what the future might hold for prices. And let’s not forget how spotting and understanding these patterns can help traders play it smart, handle the risk like a pro, and snag those sweet trading opportunities.

Table of Contents

B. The Lowdown on the 7 Patterns We’re Covering:

Alrighty, in this next bit, we’re giving you a quick rundown of the seven big-time day trading patterns we’ll be dissecting throughout this guide. We’ll be introducing each pattern, shining a light on why it’s a big deal, what makes it tick, and how you can put it to work in your day trading game. Our goal? To make sure you’re all clued up on these patterns and how they fit into your day trading playbook.

II. Let’s Talk Head and Shoulders

A. Breaking Down the Head and Shoulders:

Now, let’s zoom in on the head and shoulders pattern, a real rockstar in technical analysis. We’re clearly defining what this pattern’s all about, chatting about its key features (think three peaks and valleys doing their best human impression), and digging into why that neckline support/resistance is a big deal.

B. Nailing Down How to Spot It:

So, how do you go about spotting these head and shoulders on those price charts? We’re giving you the lowdown, breaking down the nitty-gritty of what to look out for, like those peaks and troughs, symmetry, and giving volume analysis a nod. Besides, we have a few helpful hints and visuals to ensure you’re not thinking twice, regardless of what the market’s tossing your direction.

C. Getting Down to Exchanging Business

Time to discuss work! We’re tossing out some different trading strategies tailored for when you’re eyeballing that head and shoulders pattern. We’re dishing on where to hop in and out of trades, where to park those stop-loss orders, and how to ride the wave when that pattern’s confirmed.

D. Real-Life Tales from the Trenches:

Alright, let’s bring this pattern to life with some real-world examples straight from the market charts. We’re dissecting how these patterns played out, what went down next, and why it’s crucial to soak up those historical lessons to level up your pattern-spotting game.

III. The Scoop on Cup and Handle Patterns

A. Getting Acquainted with the Cup and Handle:

Now, let’s chat about the cup and handle pattern, a bullish contender in the technical analysis arena. We’re breaking down its formation, from that cup-shaped base to the little consolidation dance it does with the handle. And we’re not leaving out why this pattern’s like a neon sign pointing up for potential price action.

B. Spotting Cups and Handles Like a Pro:

So, how do you pick out these cups and handle formations from the crowd? We’re spilling the beans on what to keep an eye out for, like that rounded cup bottom and the snug little handle formation. Plus, we’re serving up some practical tips and examples to help you separate the wheat from the chaff in the market hustle and bustle.

C. Getting in on the Action:

Time to roll up those sleeves and talk tactics! We’re throwing out a smorgasbord of strategies for when you’re ready to pounce on that cup and handle setup. We’re hashing out the best spots to jump in after that handle’s resistance is toast, and dishing on how to set those profit targets and stop-loss levels like a seasoned pro.

D. Real-Life Adventures:

Let’s take a trip down memory lane with some real-life case studies showing off these cups and handle patterns in action. We’re breaking down what went down, how it all played out, and why it’s essential to have your pattern recognition game on point for those clutch trading decisions.

IV. Double Trouble: Double Top and Double Bottom Patterns

A. Diving Deep into Double Trouble:

Brace yourselves for a double dose of pattern fun with the double top and double bottom formations. We’re laying down the law on what makes these patterns tick, from those twin peaks (or valleys) chilling at the same price party to why they’re like the market’s version of a U-turn sign.

B. Nailing the Spotting Game:

All in all, how would you isolate the genuine article from the fakers about these twofold difficulty designs? We’re spilling the beans on the key characteristics to scope out, like those consecutive peaks or valleys. And you bet we’ve got some handy-dandy tips and examples to make sure you’re not getting duped by market noise.

C. Strategies for Maximizing Gains:

We’re spreading out a smorgasbord of procedures for handling that twofold top and twofold base examples head-on. We’re hashing out where to get in and out of those trades, what signals to keep an eye out for, and why setting those stop-loss levels is like having a safety net for your trading adventures.

D. Live and Learn:

Let’s wrap up this section with a few tales from the trenches, showcasing these double trouble patterns in action. We’re dissecting what went down, why it mattered, and why having your pattern recognition game on point is essential for those live trading moments.

V. Three-sided Stories

A. Triangle Talk:

Presently, we should plunge into the interesting universe of triangle designs, where rising, sliding, and even triangles become the dominant focal point. We’re giving you the 411 on each type, from how they form to what they mean for price movement. And buckle up, because these patterns are like the market’s way of taking a breather before deciding which way to go next.

B. Spotting Triangles in the Wild:

So, how do you spot these triangle formations amidst the chaos of the market? We’re laying it all out for you, from converging trendlines to the telltale signs of decreasing volatility. Also, just sit back and relax, we have a lot of functional tips and visual guides to ensure you’re not passing up these tricky examples.

C. Strategies for Breakout Brilliance:

We’re presenting a buffet of systems for handling those triangle breakouts head-on. We’re talking about where to jump in and out of those trades, what signals to keep an eye on, and why setting those stop-loss levels is like having a safety net for your trading adventures.

D. Lessons from the Trenches:

Let’s wrap up this section with a few stories from the front lines, showcasing these triangle patterns in all their glory. We’re breaking down what went down, why it mattered, and why having your pattern recognition game on point is essential for those clutch trading moments.

VI. Flags and Pennants: Riding the Wave

A. Unraveling Flags and Pennants:

Time to unravel the mysteries of flags and pennants, the unsung heroes of continuation patterns. We’re shedding light on their formation, from that brief consolidation phase to why they’re like the market’s way of catching its breath before the next big move.

B. Sorting Flags from Pennants:

So, how do you tell these bad boys apart? We’re dishing out the secrets, from the key characteristics that set flags apart from pennants to some nifty examples to help you become a bona fide pattern detective.

C. Strategies for Flag and Pennant Power:

Let’s get down to business! We’re serving up a feast of strategies for tackling those flag and pennant setups like a pro. We’re talking about where to enter and exit those trades, what signals to watch for, and why managing risk like a boss is the key to success.

D. Tales from the Trading Floor:

Let’s wrap up this section with a few tales from the trading floor, showcasing these flag and pennant patterns in all their glory. We’re dissecting what went down, why it mattered, and why having your pattern recognition game on point is essential for those live trading moments.

VII. The Lowdown on Wedge Patterns

A. Wedges 101:

Get ready to dive into the world of wedge patterns, where rising and falling wedges reign supreme. We’re breaking down their formation, from those converging trendlines to why they’re like the market’s way of hinting at a potential trend continuation or reversal.

B. Spotting Wedges Like a Pro:

So, how do you spot these wedge formations amidst the chaos of the market? We’re giving you the inside scoop, from the key features to look out for to some real-world examples to help you become a wedge-spotting whiz.

C. Strategies for Wedge Wonders:

We’re presenting a smorgasbord of systems for handling those wedge breakouts head-on. We’re talking about where to jump in and out of those trades, what signals to keep an eye on, and why managing risk like a pro is the name of the game.

D. Tales from the Trenches:

Let’s wrap up this section with a few tales from the trenches, showcasing these wedge patterns in all their glory. We’re dissecting what went down, why it mattered, and why having your pattern recognition game on point is essential for those clutch trading moments.

VIII. Conclusion

In conclusion, how about we wrap things up, will we? We’re plunging profound into the essence of what we’ve found out about day trading patterns. This part is like the backbone, reminding us how vital it is to spot and grasp these patterns for our trading game. It shouts out loud about how pattern recognition shapes our moves, keeps risks in check, and snags those sweet market opportunities.

But wait, there’s more! It’s all about keeping our pattern skills sharp through constant learning and tweaking. We’re nudging traders to put what they’ve soaked up from this guide into action, tweaking their strategies to dance with the ever-changing market tunes.

And hey, there’s some last-minute advice for our traders too. We’re preaching the gospel of discipline, patience, and emotional grit in this wild world of day trading. Plus, we’re tossing in a few extra nuggets of wisdom and resources for those hungry to keep leveling up in the techy world of trading.

In a nutshell, we’re wrapping it all up in a bow, ensuring our readers understand how day trading patterns rule the roost and how to wield them like a pro in their trading ventures.

IX. FAQs

Q. What’s the deal with day trading patterns, and why should I care?

A. Day trading patterns? They’re like those recurring themes you spot in price charts, giving you the lowdown on what’s cooking in the market. Why should you care? They’re your secret sauce for spotting potential moneymaking moves and keeping risks in check.

Q. How do I nail spotting day trading patterns?

A. Spotting those day trading patterns ain’t no cakewalk. It takes a good dose of know-how, experience, and some sharp technical analysis skills. You gotta keep an eye out for those telltale signs on price charts think head and shoulders, triangles, or flags, and double-check ’em with other indicators.

Q. Can I bet my chips on day trading patterns to predict future price moves?

A. Day trading patterns? They’re like your market whisperers, but hey, they ain’t infallible. Market vibes can switch gears quicker than you can say “sell.” So, while they dish out handy signals, remember to mix ’em up with other analysis tools and risk management smarts.

Q. How do I spice up my trading game with day trading patterns?

A. Wanna level up your trading mojo? Throw in some day trading patterns. They’re your ticket to spotting juicy entry and exit points, setting those profit targets, and keeping risk monsters at bay. Get cozy with them, and you’ll make savvy moves in no time.

Q. What boo-boos should I dodge when riding the day trading patterns wave?

A. Ah, the pitfalls of day trading patterns! Don’t get caught up in the hype of pattern-spotting alone. Remember to sprinkle in some risk management fairy dust and stay nimble in the face of market twists. Keep your cool, stay patient, and treat each trade like a learning adventure.

Q. Where’s the best place to dive deeper into day trading patterns?

A. Prepared to plunge carelessly into the universe of day trading patterns? There’s a gold mine of assets hanging tight for you on the web – from clever instructive destinations to must-understand books and courses. Oh, and don’t forget to flex those pattern-spotting muscles with historical charts and real-time market data.