I. Introduction

Best Budget App Reddit

Budgeting is indeed a basic element of personal finance management, which enables people to take control over their money and reach their financial objectives as well as have more financial freedom. Over the past years, there has been a sharp increase in the popularity of budget apps recommended by Redditors. Redditors’ candid and genuine opinions made them an invaluable source for anyone looking for reliable advice on budgeting tools. This blog post will delve into the features, user experiences, and overall effectiveness of each of these best five Reddit-recommended budgeting applications in 2024.

Table of Contents

Why Budgeting Matters

Let us first understand why it’s important to budget before reviewing specific budgeting apps. Budgeting offers many advantages when it comes to reaching your goals financially. It allows individuals to track their income and expenses thus helping them live within their means. By managing expenses, people can identify areas where they can reduce costs and save money too. Also, through budgeting one can assign funds towards debt reduction and savings that helps them build a strong financial base as well.

Reddit as a Resource

Reddit has grown into a great source of information on many different topics including personal finance and budgeting because of its diverse and active community. Reddit provides insight into budgeting apps by real users who have had first-hand experiences with these tools. These user experiences and opinions, create an all-encompassing picture devoid of bias on the strengths and weaknesses of various budgeting apps.

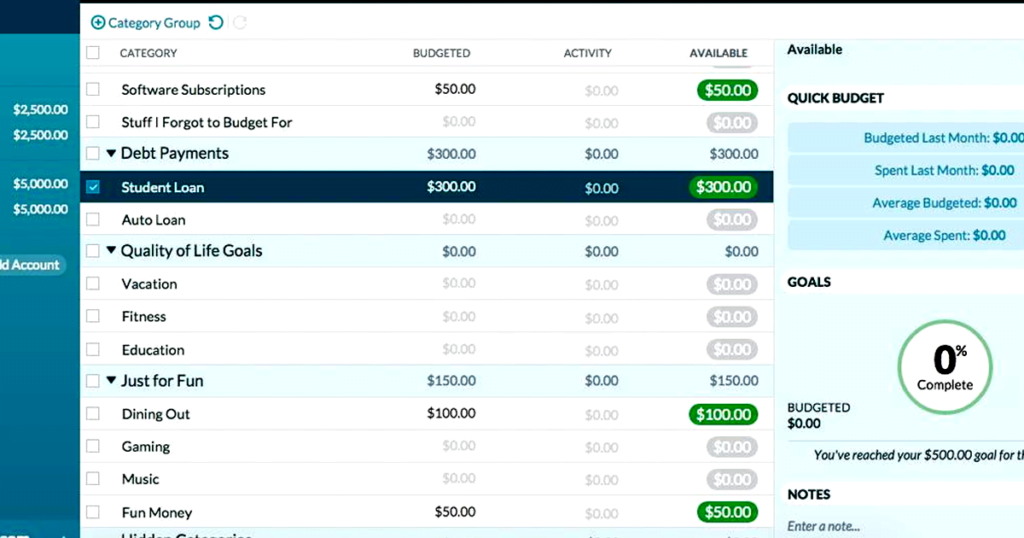

II. YNAB (You Need A Budget): Best Budget App Reddit

One of the top budget apps that people recommend on Reddit is YNAB (You Need A Budget). YNAB is extraordinary due to its smooth and simple interface, robust features, and unique budgeting system.

Budgeting Methodology

YNAB has a special approach to budgeting where it assigns every dollar a job. This means that income in dollars is assigned to categories or expenses so that every dollar is spent correctly. Through this method, people can have a better understanding of their financial standing thus they can be wise while spending money.

Characteristics and Instruments

The software has a variety of features and tools that allow for effective budget management. It enables tracking of goals, such as saving an amount or buying something. More so, it can keep track of expenses by entering them manually to determine how much was spent in each category. Furthermore, the system sends reminders about bills to avoid missing due dates and paying late fees.

User Reviews and Experiences

Individuals who have used YNAB attest that it is the best app they have ever come across while others consider it as life-changing. For example, some users say that they managed to pay off their debts thanks to the app while others share how they could save enough money for future hardships that may occur at any time unexpectedly. Nevertheless, some other customers found that it took them quite a long time to learn everything concerning using the product.

III. Mint (Best Budget App Reddit)

According to Reddit reviews, Mint is another great alternative financial planning tool that works well on mobile apps and online platforms; offers budgeting functions, and alerts clients about approaching payments so as not to miss any deadlines again when paying their bills later than necessary.

Account Integration and Tracking

Mint can be connected to different financial accounts making it among the best budgeting applications as users do not have to use several programs to check on their money situation at once. Such banks such as credit cards and many other financial institution transactions are automatically imported by it thus making it easy for someone to follow up on their expenses and income. With this kind of integration, time that otherwise could have been spent on data entry can be saved allowing focus on budgeting instead.

Bill Management and Alerts

Mint will notify you about your bills before they fall due; also you get a view of your payment history among others in bill management. Bills can be summarized within the app’s interface whereupon users may also plan payments directly. To prevent late payments, all billers including these dates may be assessed from only one place.

Reddit Users’ Feedback

The Reddit community applauds Mint for being dependable, user-friendly, and practical when it comes to money-management issues. Many users have commented positively regarding having an overall picture of their expenditures plus incomes which helps them work out proper economic decisions. Conversely, some feel that it has some minor mistakes in identifying categories, and customization options are limited.

IV. EveryDollar (Best Budget App Reddit)

The emerging budget application called EveryDollar is suggested by Redditors for its simplicity and efficiency in budgeting as well as expense tracking.

Zero-Based Budgeting Approach

EveryDollar has a zero-based budget approach, where every single income dollar is assigned to a particular category. This strategy ensures that people assign some purpose to each of their dollars and avoid overspending. Capitalizing on all money, individuals become more accountable about their finances and can prioritize their financial targets.

Expense Tracking and Reports

The app is designed with easy-to-use expense tracking tools that enable users to effectively categorize and monitor their costs. Users can observe general spending patterns through the app so that they can identify areas where they may be overspending easily. In addition, comprehensive reports generated by EveryDollar provide user-friendly insights into spending habits which help in making essential adjustments.

Reddit Community Insights

Reviews and experiences shared by Reddit users highlight EveryDollar’s simplicity and effectiveness.

Users appreciate the straightforward interface of the app which enables them to do budgeting and track expenses without hassles.

While some users mention a lack of flexibility in adjusting budgets once they are set, the overall consensus is that EveryDollar is a practical and user-friendly budget app.

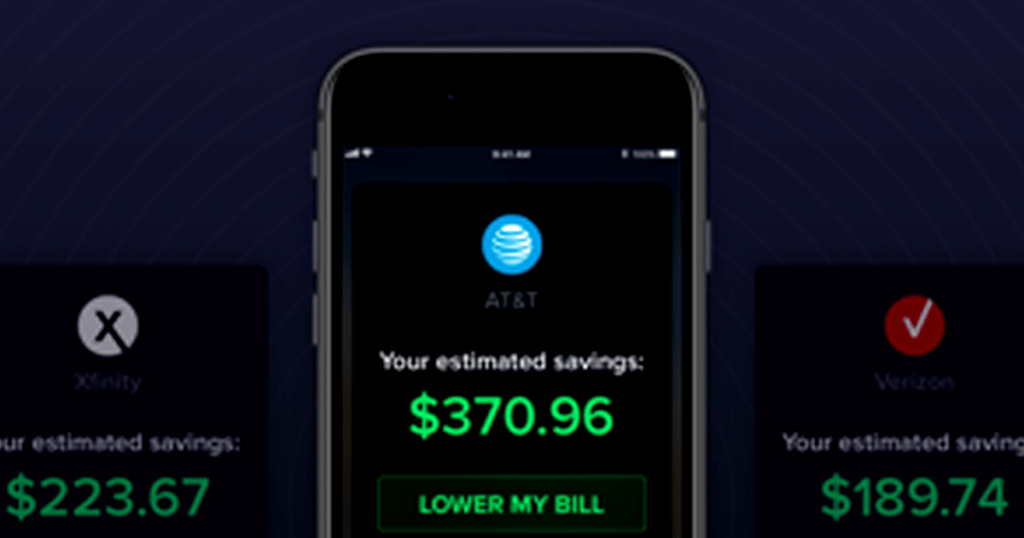

V. PocketGuard (Best Budget App Reddit)

This is an application that helps in managing personal budgets and has attracted a lot of attention on Reddit because it has some special features that make it more usable.

Automated Expense Analysis

PocketGuard, compared to other budgeting apps, is unique in its capacity to automatically categorize and analyze the spending patterns of people. This allows users to track their expenditures in real time since the application can be connected with different financial accounts owned by individuals and then provide them with up-to-date information regarding their expenses. Such an analysis will help individuals to recognize their spending habits better to optimize their budgets realistically.

Goal Setting and Savings Strategies

Through PocketGuard, one can also set goals in terms of saving money as well as keep track of how effective he/she is doing towards achieving such targets. For instance, if someone wants to save money for a holiday or an emergency fund, this app will help him/her reach these targets step-by-step. Moreover, the software also offers suggestions about saving patterns that are appropriate for the user’s situation.

Reddit Recommendations and Opinions

Automated spending trackers that easily put your financial data into perspective in real-time were however highly praised by Redditors who regarded PocketGuard simply as simplicity at its best when it comes to automation of expense tracking – there was no need for extravagant statistical functions like many other apps offer according to these customers, as they say, that “simple things work best”. However, some experienced issues connecting certain banks once in a while.

VI. Conclusion

Thus, Reddit spoke, and the outcome was 5 best budget app Reddit to try out in 2024. These include YNAB, Mint, EveryDollar, and PocketGuard. They offer differing approaches as well as unique features that can assist individuals in achieving their personal financial goals. Therefore, various budgeting preferences and user needs should be considered such as budgeting methodology, features, and ease of use when finding the right budget app.

Which Budget App Fits Your Needs?

Examine these applications for your affected finances carefully to establish which suits you most specifically. Evaluate the kind of spending plan that works best for you; identify the attributes that are central to your fiscal management; and judge each’s overall ease of use. You can gain significant control over your finances by choosing the right tool among them.

Start Your Budgeting Journey Today

Money management is an influential tool that leads to economic freedom. To begin managing your own money to apply this article’s teaching requires acting upon it now. No matter if it is YNAB Mint EveryDollar PocketGuard or other budget apps, the key here is starting with action making budgeting a habit regularly. With the right budgeting app, you can achieve your financial goals and have a brighter future financially.

VII. FAQs

Are these budget apps ideal for users with a variety of income levels?

Yes, for people who have different amounts of money coming in, there are such applications. They offer elasticity and adaptability to fit any financial situation.

Can I use several budget apps at the same time?

Using many budget apps simultaneously could be counterproductive because it may result in confusion and contradictory information. It is advisable to select one app that meets your specifications and stick to it.

Do these apps give sync across different devices?

Yes, they do, this is because these types of budget apps do provide for synchronization across various platforms which may include smartphones, tablets as well and computers enabling their users’ access to their budgets irrespective of where they are going

Is there any budget app meant for small businesses only?

Although the ones discussed here concentrate on individual finance management, there exist some other business-specific budget tools or software that are available in the market today. Thus it is recommended to look into choices that will suit a small entrepreneur’s requirements most effectively both in terms of finances or otherwise since needs vary from one business owner to another.

Will my investment accounts be connected with these control cash flow applications so that I can enhance my money accountability?

One can personalize budgeting categories and set customized spending limits in line with my specific financial needs and goals. Some of these budget apps allow users to connect their investment accounts for full financial tracking. It is a feature that gives one a comprehensive view of his or her entire financial wellness.

Are these budget apps good for people who have different approaches towards their finances like those who want to save for a particular purchase or pay back money they owe?

Yes, this app is good for people with varying financial goals. They usually have tools where you can set and monitor specific financial aims like saving for a holiday, buying a car, or clearing debts. This way anyone can set their objectives and monitor their progress over time to keep them motivated and directed at achieving what they have planned financially.

Do these applications come equipped with features that help me to track irregular income or expenditures such as freelance payments or occasional big-ticket items?

Yes, many of these apps have functions that allow us to track abnormal incomes or expenditures. Users can classify incomes and expenses including non-recurring sources of revenue or one-time huge expenses. In this manner, they enable them to get an insight on how their money moves to properly plan their income and expenditure even when it seems difficult due to monthly fluctuations in earnings.

Could I assign personalized spending caps for certain categories on my budget plan so that they reflect my economic situation more accurately than others?

Most of them do. Budget apps are capable of being customized by users so that individuals can select their personal preferences when it comes to spending limits and categories. Categories such as groceries, transportation, entertainment, etc., may be created by the user which is reflective of their unique financial situation and priorities. Furthermore, for each category, they can fix limits based on their budget objectives and monitor the expense vis-à-vis the limit.

Can these applications learn anything from my spending patterns to provide me with better financial advice?

Yes! Most of them do. Insights as well as recommendations based on individual spending habits are available in numerous budget apps. For instance, some may analyze expenditure trends, point out areas where money can be saved or costs reduced, and provide ways of improving financial well-being. By doing this users will have more informed choices leading towards effective realization of financial aspirations.

Are these budget apps secure? How is my privacy protected by these apps?

Budget apps make efforts to guarantee the safekeeping and privacy of users’ financial data. They usually employ encryption to safeguard data on the move and in storage, and they might also incorporate additional security measures like two-factor authentication services. Moreover, budget apps respect guidelines that regulate how such apps gather, utilize, and distribute information about users thus enabling fair disclosure and monitoring of personal details.

1 thought on “Best Budget App Reddit: 5 Must-Try Financial Tools of 2024”